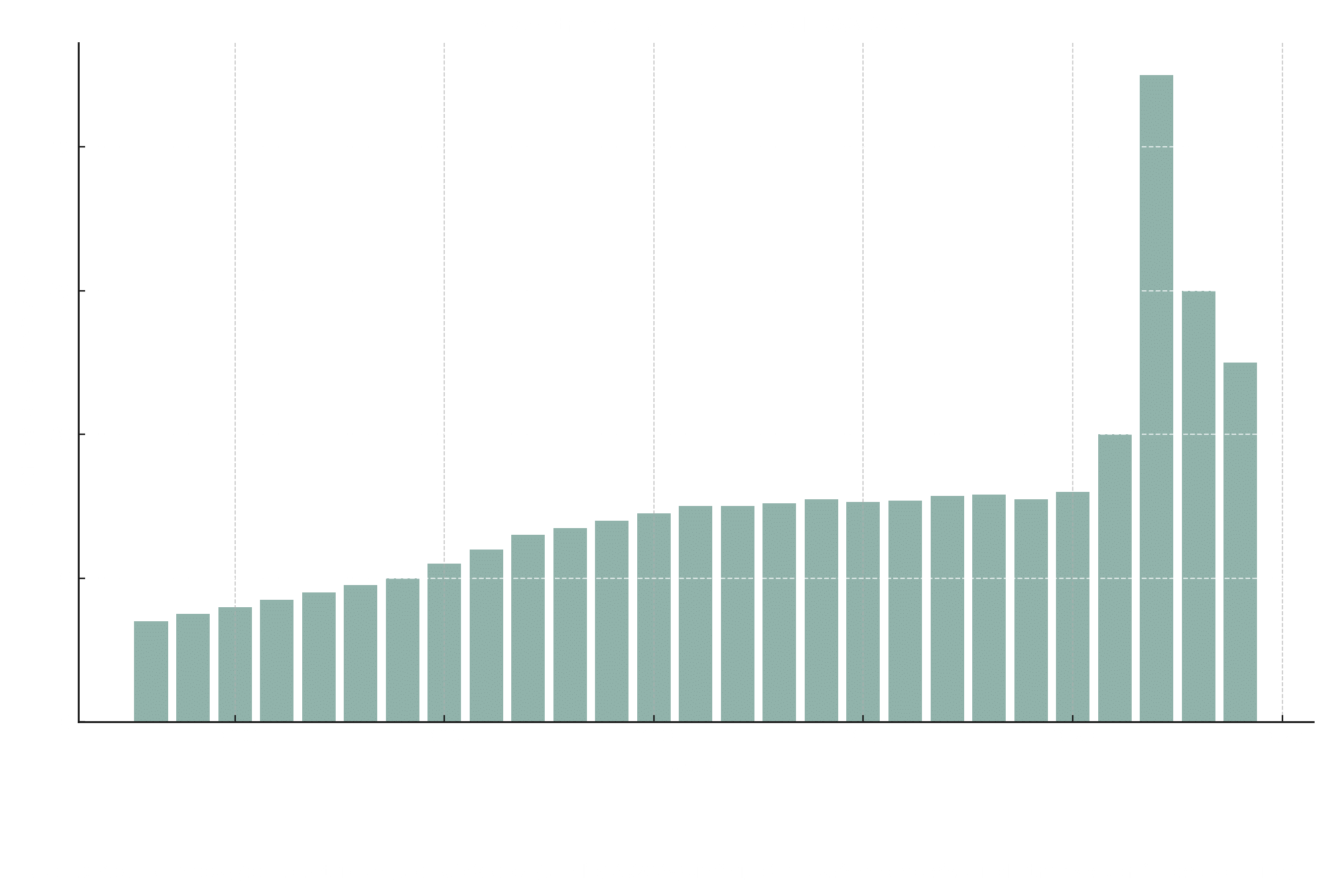

Energy prices have risen sharply in recent years, posing major challenges for companies. While European wholesale electricity prices remained relatively stable at between EUR 40 and 60/MWh between 2015 and 2019, they rose to up to EUR 400/MWh in 2022 as a result of global events such as the COVID-19 pandemic and geopolitical crises (European Commission, 2024). Despite a decline to EUR 95.18/MWh last year, the price trend remains volatile (SMARD, 2023). This unpredictability significantly impairs the planning security and competitiveness of companies, especially in energy-intensive sectors.

One solution to counter rising energy costs is the integration of intelligent storage solutions. Commercial electricity storage systems enable companies to temporarily store cheap electricity – from photovoltaic systems, for example – and use it when needed. This not only reduces energy costs, but also offers greater flexibility and security of supply.

The cost of a commercial storage system depends on many factors and varies according to individual requirements. They can be divided into three main categories:

A typical price scenario: Commercial storage systems range in price from EUR 450 to EUR 800 per kWh of storage capacity (PV Magazine, 2021). For example, a 500 kWh system could cost around EUR 275,000, based on an average price of EUR 550 per kWh. Please note that this is only an example for illustrative purposes – the exact costs can vary greatly depending on the project.

Despite high investment costs, commercial storage units offer considerable financial benefits:

The payback period for a commercial storage system is typically between five and ten years, depending on the size of the system and individual energy prices (ResearchGate, 2023; PV-Magazine, 2017). Companies can refinance the investment by optimizing their own consumption and capping peak loads (KfW, n.d.).

In addition, numerous funding programs are available, such as loans from the KfW Bank. Regional subsidies can also reduce investment costs and shorten the amortization period.

In addition to direct savings, commercial storage systems also offer additional economic and environmental benefits. Commercial storage facilities can be depreciated as an investment over a fixed period of time, which brings companies additional financial benefits (Solarwatt, n.d.; Steuern.de , n.d.). Furthermore, a commercial storage facility improves a company’s carbon footprint by promoting the use of renewable energies.

Development in the field of energy storage continues to progress rapidly. One key trend is the falling cost of batteries. In the past year alone, the cost of manufacturing batteries has fallen by around 40% (Handelsblatt, 2023).

In the long term, investing in a commercial storage system is extremely profitable for companies. In addition to the considerable savings potential and the possibility of optimizing self-consumption, storage systems contribute to operational reliability and sustainability. Subsidy programs and falling battery costs further shorten the payback period, allowing companies to realize not only economic but also ecological benefits.

Request an individual cost analysis now and find out how a commercial storage system can sustainably reduce your company’s energy costs.

Similar questions often arise in connection with the purchase and use of commercial storage systems. Here you will find answers to some of the most frequently asked questions:

The cost of a commercial storage system varies depending on the storage capacity, technology used and individual installation requirements. In general, prices are between 450 and 800 euros per kilowatt hour (kWh) of storage capacity. For example, a 500 kWh storage system would cost between 225,000 and 400,000 euros. However, this estimate is only a guideline, as the exact costs must be determined by the specific requirements and technical conditions on site (PV-Magazine, 2021).

Companies can make use of various funding programs to reduce the acquisition costs of energy storage systems. One important funding instrument is the KfW Bank, which offers low-interest loans for energy storage projects. In addition, some federal states and local authorities offer special grants. However, these subsidies are often limited and subject to a cap, so companies should look for available options promptly in order to benefit from the programs (KfW, n.d.).

The payback period for a commercial storage system is usually between five and ten years. Factors such as the size of the storage system, the company’s energy consumption, possible savings through self-consumption optimization and the avoidance of peak loads play an important role. Subsidies and tax benefits can also shorten the payback period, meaning that the investment becomes profitable earlier in many cases (ResearchGate, 2023; PV-Magazine, 2017).

The optimum storage size depends on your company’s energy consumption, the size of your energy generation system (e.g. photovoltaics) and your individual load profile. A precise analysis of the energy demand and load distribution is crucial in order to avoid oversizing or undersizing the storage system. The aim is to select the size of the storage system in such a way that as much self-generated electricity as possible is used without incurring unnecessarily high investment costs (Westenergie, n.d.).

Commercial storage systems make it possible to store electricity when prices are low and then use it when electricity prices rise. This not only significantly reduces energy costs, but also protects the company from the risks of volatile energy prices. In phases of strong price fluctuations, a commercial storage system thus offers financial security and improves the predictability of energy costs (European Commission, 2024).

Once a commercial storage system has been installed, the main costs incurred are for maintenance, software updates and monitoring the system. These operating costs are usually moderate and hardly affect the overall cost-effectiveness of a storage system, especially if the storage system has been properly planned and integrated into the existing energy management system (PV-Magazine, 2021).

Yes, the purchase of a commercial storage unit can be written off as an investment for tax purposes. As a rule, depreciation takes place over a period of several years, which leads to a significant reduction in the tax burden. This depreciation offers companies an additional financial advantage and contributes to the profitability of the project (Solarwatt, n.d.; http://Steuern.de, n.d.).

Yes, commercial storage systems can take on an emergency power function. In the event of a power outage, they ensure that important systems and production processes continue to operate. This minimizes the risk of production downtime and significantly increases the company’s operational reliability, which is particularly important in critical industries (Westenergie, n.d.).

These questions provide an overview of the most important aspects that play a role when deciding on a commercial storage unit. If you have any further questions or would like individual advice, please contact us for a customized solution.

Source 1: Report on energy prices and energy costs in Europe, https://eur-lex.europa.eu/legal-content/DE/TXT/PDF/?uri=CELEX:52024DC0136

Source 2: https://www.smard.de/page/home/topic-article/444/211756

Source 4: https://www.westenergie.de/netzservice/de/produkte/produkte/batteriespeicher.html

Source 6: https://www.pv-magazine.de/2017/05/22/schnelle-geschaeftsmodelle-fuer-gewerbespeicher/

Source 7: https://www.kfw.de/inlandsfoerderung/Unternehmen/Energie-Umwelt/Produktfinder/

Nutzen Sie die Förderung für Stromspeicher in Sachsen-Anhalt, um Ihre Betriebskosten zu senken und in eine effiziente Energiezukunft zu investieren. Lassen Sie uns Ihr Projekt gemeinsam angehen.